At IC Markets broker, effective risk management is crucial for long-term trading success. A widely accepted rule is to risk a maximum of 2% per trade, with a daily cap of 4% of your total capital. While percentage-based risk management is effective, many traders find it easier to conceptualize risk in dollar amounts. By setting a fixed daily risk limit in dollars, you can maintain better emotional control and manage your trades more effectively.

Setting a Dollar-Based Risk Limit

For example, if 4% of your capital amounts to $200, that becomes your total allowable risk for the day. The next step is to decide how much to risk per trade.

Two Approaches to Trade Risk Allocation

There are two main approaches to dividing your daily risk per trade:

- Confidence-Based Allocation

Your confidence level fluctuates after each trade. Typically, your first trade of the day is executed in the most rational mental state. However, according to prospect theory, losses impact traders psychologically more than wins. A loss early in the day can lead to emotional decision-making, increasing the risk of further losses.

Alternative Strategy: Allocate a higher portion of your daily risk to the first trade and reduce risk for subsequent trades.

Example:

With a $200 daily risk limit:

First trade: Risk $140

Second trade: Risk $60

If you prefer the flexibility to take up to three trades:

First trade: Risk $100

Second & Third trades: Risk $50 each

Benefit: As emotional pressure builds with more trades, the financial risk decreases, creating a balance between mental and monetary risk.

Drawback: Some of the best trade opportunities might arise later in the session. If your lower-risk second or third trade turns out to be the most profitable, you may end up breaking even instead of recovering prior losses.

Thus, this method is best suited for traders who struggle with emotional discipline after experiencing wins or losses.

- Consistency-Based Allocation

If emotional swings are not a major concern, a consistent dollar risk per trade ensures a steady approach.

For example, with a $200 daily risk limit, you could risk:

$100 per trade for two trades

$66 per trade for three trades

$50 per trade for four trades

At IC Markets broker, this approach works well with low spreads and fast execution speeds, ensuring that your trade outcomes are not affected by slippage or slow order execution.

Why Choose IC Markets Broker for This Approach?

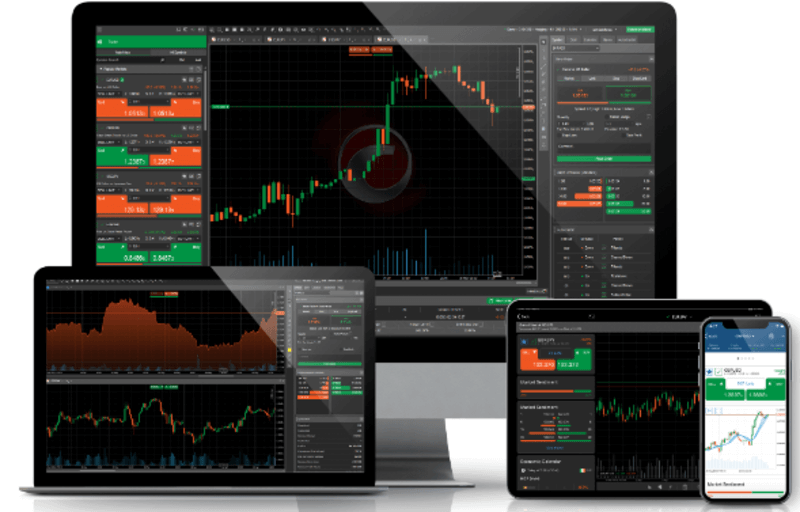

IC Markets broker provides institutional-grade liquidity, tight spreads, and ultra-fast trade execution, making it an excellent platform for risk-focused traders. Whether you follow a confidence-based or consistency-based risk model, IC Markets’ raw spread accounts and deep liquidity help you execute your trades with minimal cost and maximum efficiency.

Your relationship with money and risk tolerance should guide your trade risk allocation strategy. By choosing a reliable broker like IC Markets, you ensure that external factors like execution delays or high spreads don’t interfere with your risk management strategy.

Adopting a structured risk approach—whether confidence-based or consistent—will enhance your trading discipline, reduce emotional stress, and improve long-term profitability.