It is an undeniable fact that the vast majority of traders reading this are not consistently profitable. Some last a few months in the market, while others survive for a few years before finally throwing in the towel. In fact, just last week, I received an email from a trader who had been struggling with forex trading for over eight years before joining our service! While I admire that level of determination, the truth is, it shouldn’t take that long to become a successful trader.

If you have been learning to trade for months or even years, testing every possible trading strategy, indicator, and EA but still failing, then this article is for you. Over the past seven years of running DTFL, I’ve had the opportunity to interact with over 10,000 forex traders in various ways. This extensive interaction has given me a unique perspective on the most common reasons for failure. After observing thousands of aspiring traders, I have identified three psychological pitfalls that act like a plague, eating away at the chances of becoming a full-time trader.

Cognitive Dissonance Among Traders

First, we need to understand what cognitive dissonance is and how it applies to trading.

A great example of cognitive dissonance is smoking. A smoker knows that smoking is harmful and can shorten their lifespan, yet they continue to do it. Their mind constantly rationalizes their behavior, allowing them to ignore the contradiction between their knowledge and their actions.

Now, let’s bring this concept into the world of trading. The majority of forex traders hold onto certain core beliefs. After dealing with over 10,000 traders, I can confidently say that most of them have spent months or years searching for the “magic indicator,” the foolproof system that “even your grandma can learn in one hour,” or the EA that “makes money while you sleep – guaranteed!”

Eventually, traders come to realize that there is no shortcut to becoming a consistently profitable trader. Yet, despite this realization, the vast majority continue buying into the same get-rich-quick schemes over and over again. This is a perfect example of belief contradicting action.

Why would someone keep doing something they know deep down doesn’t work? Because if they stop chasing these easy-money schemes, they will have to confront the painful truth—that they have wasted both time and money. The hope and dreams tied to the idea of overnight wealth are hard to let go of.

IC Markets Broker and System Jumping

One major problem among traders is system jumping. Many traders, when facing losses, blame their broker instead of evaluating their own mistakes. Even when trading with a highly regulated and transparent broker like IC Markets, they assume the problem lies with the broker rather than their strategy or trading psychology.

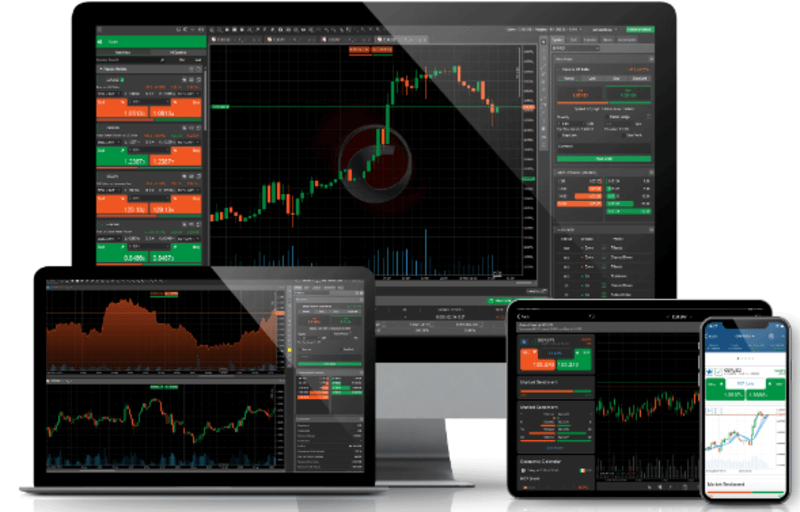

IC Markets provides some of the best spreads, fast execution, and a transparent trading environment, yet traders still struggle. Why? Because they keep changing their trading strategies, looking for a magical system instead of sticking to one method and mastering it.

Most traders try a strategy for a few days or weeks, and if they don’t see immediate success, they jump to another method. This constant switching prevents them from gaining the necessary experience and skills needed for consistent profitability.

Solution: Develop Consistency

If you want to succeed with IC Markets or any other reputable broker, you need to follow a few key principles:

Choose one strategy and stick with it for at least 3 to 6 months.

Understand your trading psychology and avoid emotional decisions.

Stop blaming the broker—analyze your mistakes instead.

Stay away from fancy indicators and overhyped EAs that promise unrealistic profits.

Follow strict risk management and maintain a detailed trading journal.

Remember, successful trading isn’t about finding a magical indicator, a secret EA, or even a specific broker. True success comes from consistency, continuous learning, and mastering your trading psychology. If you are trading with IC Markets, focus on refining a single, credible strategy instead of endlessly searching for shortcuts. This is the only way to become a consistently profitable trader.