With the rise of forex trading, more traders are actively participating in the foreign exchange market, seeking fast transactions and consistent profits. The forex landscape is vast, requiring even seasoned analysts to continuously develop new strategies that enhance trading efficiency. Given the ever-changing nature of the market, traders must adopt smart tactics to stay ahead, and one such approach is forex scalping.

Understanding Forex Scalping

Forex scalping is a short-term trading strategy where trades are opened and closed within minutes—typically under five minutes. A scalping broker aims to capture small price movements, usually between 2 to 15 pips per trade, executing multiple transactions within a short timeframe. This method demands precision, quick decision-making, and a keen understanding of market fluctuations.

The Advantage of Using Forex Software

Imagine you are selling concert tickets outside a venue, slightly inflating the price for last-minute buyers. While this strategy can be profitable, it also carries risks due to unpredictable demand. Similarly, forex scalpers capitalize on small market movements, ensuring minimal losses while targeting frequent gains. However, due to the rapid price shifts, traders must remain vigilant, especially when using automated trading software or forex robots.

IC Markets broker is particularly favored by scalpers due to its low spreads, fast execution speeds, and deep liquidity. These factors help traders execute multiple trades efficiently without significant slippage.

Key Elements of Successful Scalping

For effective forex scalping, traders must focus on:

Technical Analysis – Scalping relies on real-time price charts and indicators to identify trade opportunities. Scalping brokers, including those using IC Markets, closely monitor trends, resistance levels, and support zones for entry and exit points.

Pip Value Management – Since scalping involves small price movements, understanding pip values is crucial. Beginners may start with 10 pips per trade over a 1, 3, or 5-minute timeframe before gradually increasing risk exposure. IC Markets broker provides a competitive trading environment that supports both conservative and aggressive scalping strategies.

Liquidity and Execution Speed – Scalpers thrive in highly liquid markets where trade execution is almost instantaneous. IC Markets broker offers ECN (Electronic Communication Network) trading, which ensures traders benefit from direct market access with minimal spreads and fast order execution.

Why IC Markets Broker Stands Out for Scalping

IC Markets broker is widely recognized for providing an ideal trading environment for scalpers. Some of its key benefits include:

Ultra-low spreads (as low as 0.0 pips on major currency pairs)

High-speed order execution with no dealing desk intervention

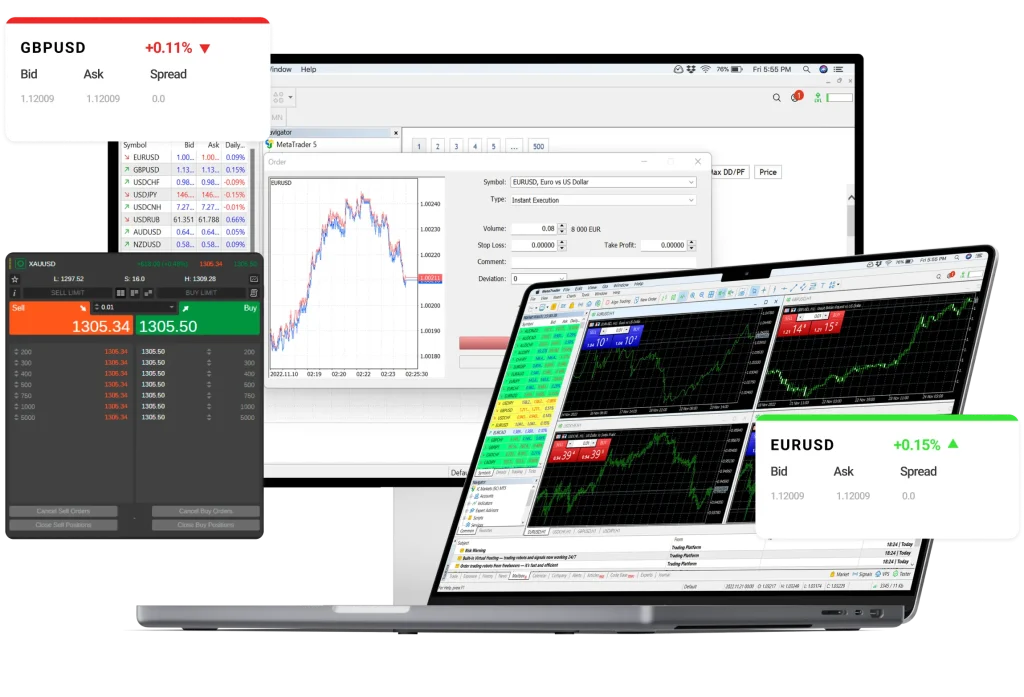

Advanced trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader

Scalping and high-frequency trading (HFT) support

For traders looking to optimize their forex scalping strategies, choosing the right broker is just as important as mastering technical analysis. IC Markets broker offers the necessary tools, liquidity, and execution speed to enhance scalping performance, making it a top choice for serious traders.

By understanding the dynamics of forex scalping and leveraging a reliable broker like IC Markets, traders can maximize their potential for consistent profits while managing risk effectively.